Why do we need decentralized stablecoins?

The promising future of Decentralized Finance (DeFi) depends on the success of stablecoins. They are the currencies of this land.

You can use stablecoin to protect from crypto volatility, lend or borrow (eg.: Aave and Compound), invest and earn yield (yield aggregators on Rari Capital), pay salaries and all the other expenses. They are programmable, global, available 24/7, move fast and cheaper than traditional money.

In the volatile world of crypto, stability has value. This benefit comes with some risks. To navigate in DeFi, you need to understand the different stablecoins categories, their peg mechanism and risks.

Stablecoins found their product-market fit as the figure below shows. There was a huge increase in supply in the last 12 months (more than 6x).

Source: Messari

The centralized stablecoins, USD Coin (USDC) and Tether (USDT), are the two giants. They keep the peg $1 by holding reserves assets in bank accounts and depend on traditional finance. To mitigate the counterparty risk, they rely on audits, but there is still a regulatory risk. It is worth noting that they have the power to freeze accounts if needed.

So, why do we need decentralized stablecoins? In face of increasing regulatory pressure, decentralized stablecoins are a good alternative for risk diversification. They tend to be more resilient in the long term and protected from regulatory attacks.

The crypto community is showing more concerns related to the centralization and censorship of the largest stablecoins. To surpass this centralization risk, each decentralized project has its peg mechanism design. There are 3 important goals to achieve: liquidity, stability and user adoption.

Let’s discover the most used decentralized stablecoins. The trading volume is an essential metric and the figure below shows the market share. DAI is the leader with a 68.3% market share ($ 417 million per day), TerraUSD is in second place with 16.5% ($ 100 million per day) and FEI is in third place with 7.5% ($46 million per day).

Source: elaborated by the author using coingecko data, October 4th. It considers the last 30 days average volume.

DAI is used within DeFi and for payments. It is widely available on exchanges, including centralized ones. So, it is very accessible to any investor. The governance token is called Maker.

TerraUSD is very integrated into payments and transfers through the Chai payment app. It is very strong in Korea.

FEI was launched in April 2021 and is mostly used within DeFi. FEI will launch its v2 with upgrades in the following months. Another interesting aspect of Fei is the current collateralization ratio of more than 330%, meaning that for each $1 circulating FEI there is $3.3 assets in collateral to defend the peg.

How do they work and what are their strengths and weaknesses?

Abstracting the details, we can separate the decentralized stablecoin in two categories: lending stablecoins and reserves stablecoins. It's interesting to note that decentralized stablecoins is a recent trend and the majority of projects listed below launched after 2020.

Source: elaborated by the author

In the lending category, users deposit collateral and borrow the stablecoin from the protocol. The stablecoins are backed by overcollateralized debt positions. For example, a user deposits $1,000 in ETH and gets (“create”) 500 DAI. This model works well when there is demand for leverage.

In the reserves category, it is more simple, users exchange an asset for the stablecoin. For example, a user exchanges $500 in ETH for 500 FEI. The assets received by the protocol are added to the protocol reserves that are used to defend the peg. The idea is that these reserves can earn yield and grow. This model is similar to central banks managing reserves. In stress scenarios, where the reserve is not enough to hold the peg, this kind of project usually allows recapitalizations of the reserve by auctioning off governance tokens.

In decentralized stablecoins, it is common to have two tokens, one that is stable and the other that absorbs the volatility. The latter is also the governance token that has voting power in the protocol and can capture value from the success of the stablecoin, in the form of buybacks, fees, etc.

To avoid a bank run movement, some projects such as Liquity USD and Gyroscope reduce the redemption value of the stablecoin in stress scenarios through greater fees or just less value redeemed. It is like a circuit breaker that gives time to restore normal operations. The idea is to discourage selling during these moments.

Another distinction, the projects pegged to fiat aim to follow the dollar value. So, 1 stablecoin is $ 1. In non-pegged cases, they do not need to follow the dollar value and can decide their target value.

From the listed projects, we have two special cases, TerraUSD and Celo, which have their own blockchain and are focused on the payment and transfer market. Both are strong on the mobile front as they are most used in apps. This is a path with many opportunities for the other projects. Increasing the presence on mobile will be key to reach the mainstream. In crypto in general we are still living in a pre-mobile internet era.

The biggest challenge for lending stablecoins is scaling and the biggest challenge for reserves stablecoins is stability in all scenarios.

Source: elaborated by the author

The future of decentralized stablecoins

New versions coming, upgrades, lessons learned, active communities and developer teams. Decentralized stablecoins are moving quickly and improving a lot.

Stability is an expectation game. If you can drive market expectations, you can win the game and achieve stability, liquidity and scalability. If the incentives are well designed, the market trusts the protocol and it is easier to hold the peg. Some questions to further exploration come to my mind:

How to best invest the protocol reserves?

How to do proper risk management of reserves?

How to make the economic link between stable token and governance token?

How to recapitalize the reserves when needed with the governance token?

How to create incentives to avoid a bank run?

How to use Layer 2 to reduce transaction costs?

In the case of reserves stablecoins, I would like to highlight the idea of dutch auctions to manage expectations. This is actually what central banks do and what FLOAT is doing. It is a capital-efficient way to auction the governance token to recapitalize the protocol reserves.

In the case of lending stablecoins, it is interesting to search for new collateral and to find more borrowers. That's one reason why DAI is exploring real world assets as collateral and engaging in some negotiations to lend to traditional finance institutions such as the French bank Societe Generale.

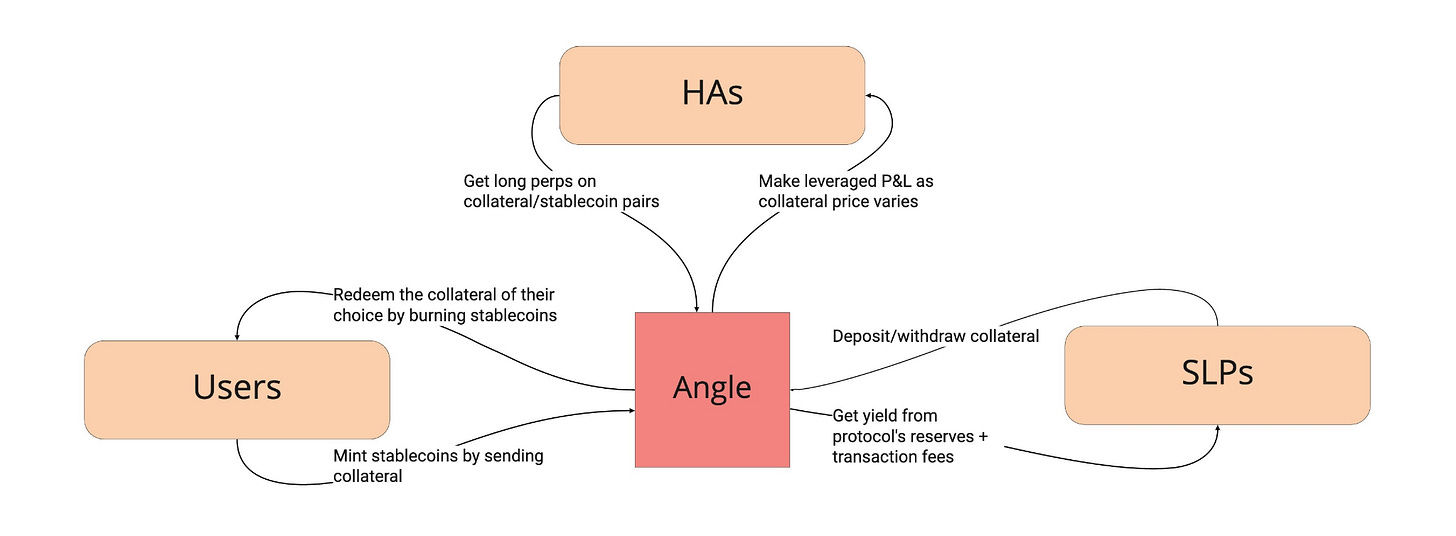

One promising field of exploration is the intersection between lending stablecoins and reserves stablecoins. This is what a new project called Angle will do. Some users (Hedging agents - HAs) can issue a stablecoin by borrowing, just like DAI, and other users can issue by providing $1 of collateral as we observe in reserves stablecoins.

Source: https://docs.angle.money/concepts/overview.

I hope that at the end of this article you can have a general overview of this shining ecosystem. It is an honor to be a community member of the Fei Protocol. I strongly believe all these teams and communities can learn a lot from each other and can cooperate in many ways. The addressable market is huge and there is a role for everyone to play.

Have a peaceful and stable day,

Bruno Rodrigues

Enter in the Crypto Kailash Telegram to receive more frequent crypto analysis updates.

Please note that this letter is not intended as financial advice.