Benchmarking on DAOs Organizational Structures

For me, one of the most interesting things emerging in crypto are the new ways humans can organize themselves to work together. Without borders, globally, everyone together, with low transaction costs to cooperate. The DAO era.

The DAOs are communities that can have multiple autonomous teams working together. It is a new world and we have a lot to test to see what works better.

How to foster engagement? How to provide accountability? How to connect multiple groups? How to attract talent and compensate them? What is a good organizational structure? And after you did it well with 10 people, how to scale a DAO?

That is a fascinating field of study. For a quick view on what is happening in DeFi, let’s talk about 4 projects: Balancer, Yearn, Index and Maker.

Balancer has a flat structure, community contributors called Ballers participate in different activities within the DAO.

The way they found to scale the DAO was to create smaller groups, called subDAOs or Pods. SubDAOs are autonomous groups of contributors empowered by token holders with a specific set of responsibilities and decision making scope.

Each subDAO has the signers (I see as a leader committee of the subDAO) and the contributors. “Non-signers can weigh in, do work, or make proposals but only the signers decide on taking action.” It is important to define who is taking the decisions and to restrict it to a small group. In a large group, no one feels responsible and it is more difficult to have accountability.

With subDAOs teams have more autonomy and are accountable to the results they are delivering.

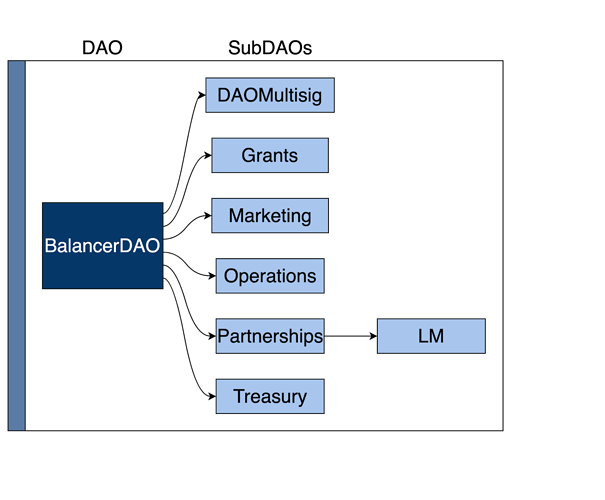

In the case of Balancer, they are structuring themselves with the following subDAOs:

Source: https://forum.balancer.fi/t/draft-proposal-balancer-subdaos-formation/2428

Their subDAOs operate in quarterly cycles for reporting, budget and goal setting.

I strongly believe that transparency is key to accountability. TRANSPARENCY is the key word. This is the way to build trust with the community. This is even more important because of the decentralized nature of DAOs. So I praise Balancer DAO for the initiative of organizing all the info related to the DAO in a notion page: Balancer DAO Super Hub.

As startups, I believe DAOs should think big, start small and grow fast with structures. Starting with a too big structure may not bring the necessary lessons learned. It is easier to increase structure than to reduce.

Balancer created an Operations SubDAO with the objective to connect each working group and provide community interface through reporting of working group progress, milestones and initiatives. Ops subDAO is the conductor of the orchestra. This subDAO is responsible for:

Onboarding

Reporting/Budget

Communication/Transparency

Compensation

Engagement

I highlight another two interesting subDAOs within Balancer DAO:

→ Marketing subDAO:

Objective: Activating and educating the DAO community.

Responsibility: *Marketing (education, awareness) *Events *Content creation

→ Partnership subDAO:

Objective: Developing and supporting strong partnerships across the ecosystem. Executing liquidity mining rewards.

Responsibility: *Partnerships (growth mechanism within protocol), *Implementing/supporting partnerships (biz dev + technical), *Liquidity Mining Committee Ensuring that liquidity mining rewards are decided upon each week, a snapshot vote is run & and updates are pushed to the github repo on time each week, *Biz Dev - partnership (due diligence)

Compensation in DAOs is another key aspect. Balancer approaches this with two categories, full and half depending on the level of value creation and engagement. This is the fixed compensation, but there is also a “bonus” that is distributed using the tool Coordinape. They are starting to test it. As I said, we are in the stage of learning through trial and error.

Let’s talk about another case, Yearn. They also have this model of multiple teams and multisigs. They are called the yTeams and define themselves as “a network of independent doers united by a shared vision”. Below you can see the organizational structure of Yearn. You can note that they also have an Ops team.

Source: https://gov.yearn.finance/t/yip-61-governance-2-0/10460

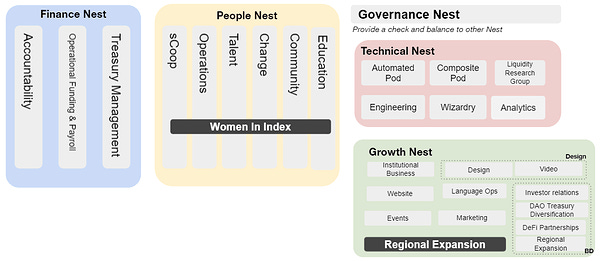

In the same line, Index Coop reformed its structure and is considering something similar to subDAOs, called Pods, small groups with autonomy and budget.

There is also the role of Index Council (Wise Owls) that have some responsibilities related to general coordination as the Ops SubDAOs from the other examples.

Another case to take a look is Maker, one of the earliest DAOs in DeFi. The figure below shows their organizational design.

The small groups in that case are the Core Units that are coordinated by elected Facilitators (Mandated Actors). They are responsible for the results and are accountable to the DAO. The Core Unit members are defined by the Facilitator. In Maker DAO model, decisions are not delegated. The core units make proposals and only MKR holders can impact the protocol.

Another interesting innovation is Optimistic governance, which enables a delegation of powers and autonomy at the same time it secures the right for token holders to veto decisions made by the Pods. Their decisions have a timelock and if token holders do not agree they can veto.

I think the implementation in each case will vary with time, but the essence will keep the same.

The key ingredients are small groups, autonomy on decision making, budget, compensation, transparency and accountability.

New governance primitives are being formed to leverage the coordination of small groups. One example is Orca Protocol that created Pods to answer to the scaling problems that DAOs face. Pods are small working groups, usually centered around one expertise and with a specific scope of decision making. Each pod has its own multi-sig wallet that is controlled by the pod members. Orca makes it easier to manage Pods.

“Podifying” a DAO can turn slow and inefficient structures into fast and fluid organizations. This reminds me of a book I read some time ago, I highly recommend it: Team of Teams: New Rules of Engagement for a Complex World.

When we have large groups, people may not feel ownership and direct responsibility over the group actions. The group size may vary depending on the context, I would say groups up to 5 members are ideal. Larger groups than that may work if the activities are very well defined for each member.

For each Pod, we need to answer the question: What are the scope of decisions that need to be made?

Another important aspect in this structure is the compensation. “Without financial incentives, network members have no reason to put their time, money, and energy into networks, vote on proposals to improve them, or care at all about their continued growth and success.“

Small groups and transparency will help to build trust within DAOs. The track record of DAO workers will cultivate reputation. And Reputation is the most valuable asset we have to coordinate as a group.

This is an interesting time to live, when humans are reinventing new ways to build things together in a global scale.

P.S.: Thanks for the comments from Arcology, Sébastien Derivaux and Solarcurve.

Please note that this letter is not intended as financial advice.