History and Future of Fei Protocol

The impact of Fei Protocol v2 for TRIBE Holders

Do you know Fei Protocol? FEI is the stablecoin for DeFi. Fei v1 introduced the concept of Protocol Controlled Value (PCV) to the DeFi space. PCV is like central bank reserves used to protect the FEI peg to $1, while enabling highly liquid Fei markets and DAO partnerships. In contrast with USDC and USDT off-chain reserves, Fei Protocol on-chain reserves help to foster the growth of DeFi. TRIBE is the governance token of Fei Protocol.

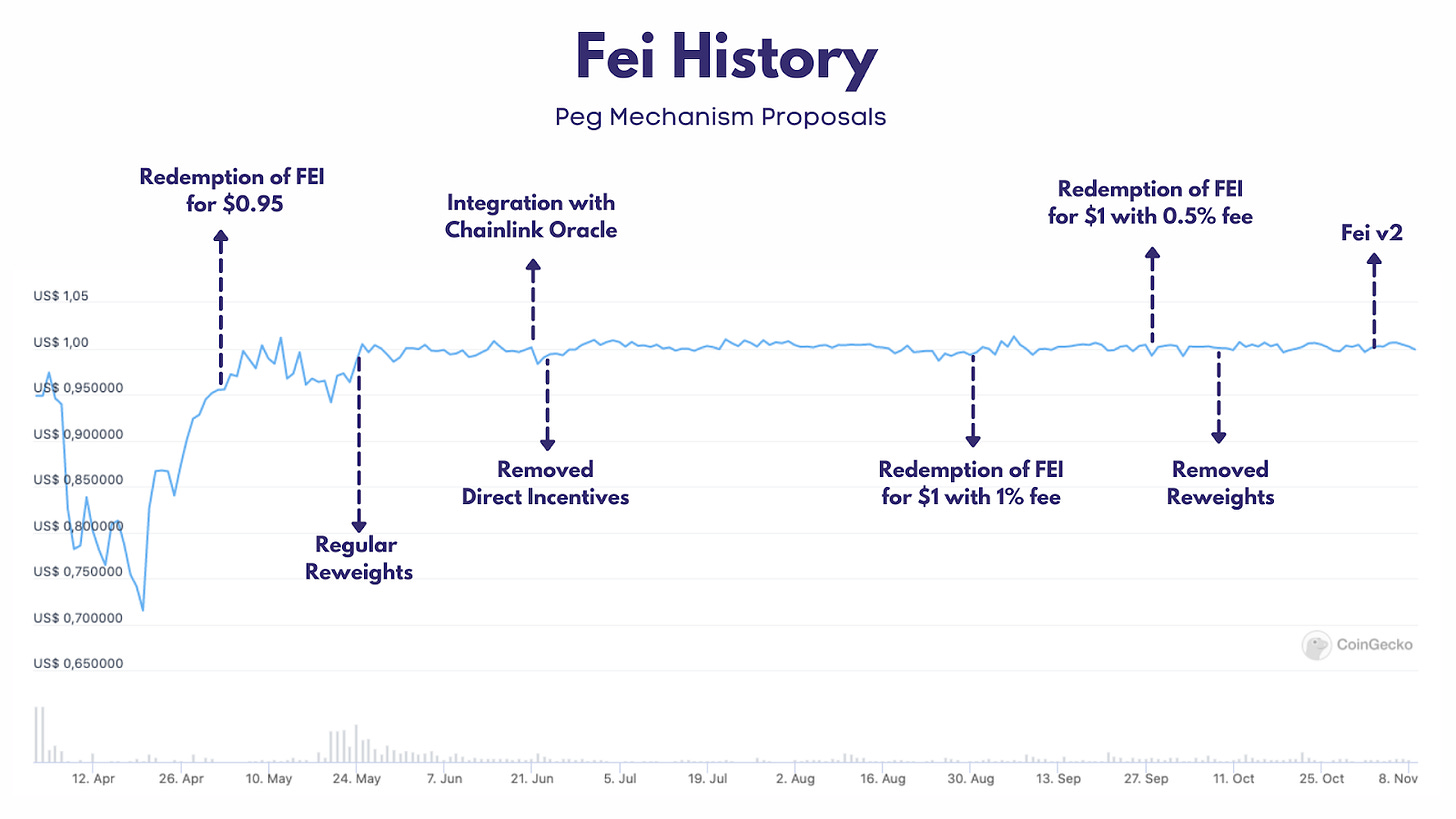

Many people heard about Fei during April 2021 and just know about the launch problems. Fei’s Genesis had much hype. The mechanisms created to keep the FEI peg to $1, reweights and direct incentives, were not working as intended. There was a lot of restrained selling pressure. Despite all the problems, Fei has never been undercollateralized. In the figure below, you can see how turbulent the first two months were.

In April and May, two initiatives released the selling pressure and helped to solve the problem. The possibility to redeem FEI for $0.95 and the activation of frequent reweights.

In June, direct incentives were completely removed and we transitioned our primary oracle to Chainlink ETH/USD from the existing Uniswap ETH-USDC TWAP. With this change, Fei’s mechanisms operated more effectively by using more up-to-date information about current market conditions.

In August, users could redeem Fei for $1 with a 1% fee and, in September, the fee was reduced to 0.5%. At that time, the reweights were no longer necessary. The redemption became the primary mechanism that FEI uses to maintain its $1.00 peg. As you can see by the figure above, the improvements were successful to keep FEI stable.

During all this difficult time, the Fei core team and the community were working hard, making significant progress on the peg stabilization mechanisms. Together, they found the solutions to build the future of the protocol.

How is Fei now? Will it be able to keep the peg? Fei Protocol’s PCV holds $1.19 B, providing a 403% collateralization ratio for all circulating FEI ($294 million). In other words, if all users redeemed Fei, the protocol would still hold a massive amount of $892 million. This is a robust Protocol Equity.

It is worth noting that PCV includes ETH, but also $120 million in other stablecoins like DAI and RAI. The stablecoins holdings help to protect the peg. FEI is one of the few truly decentralized stablecoins as PCV holds only decentralized assets. It is the second most liquid decentralized stablecoin in Ethereum, just behind DAI.

What is the impact of Fei Protocol v2 for TRIBE Holders?

Now, it's time for Fei v2! The main components of Fei v2 launch on December 15, including a completely redesigned web app for users to interact with the protocol. I will highlight three key aspects:

Incentive alignment between TRIBE and FEI holders via TRIBE buybacks and backstop. The TRIBE buybacks were already released in November. You can check it out here. The TRIBE backstop is automatic protection in case collateralization decreases below a target (initially 100%). If that happens, Fei Protocol will mint as much TRIBE as needed to back FEI users' redemptions.

Robust peg maintenance via 1:1 redeemability. A new contract offers FEI redeemability not only for ETH, but also for DAI at $1.

Efficient management of risk, liquidity, and yield via Balancer v2 pools. This will launch in Q1 2022.

What does this mean for a TRIBE holder? If the PCV appreciates, some of it will be used to buy back TRIBE. Fei v2 will improve the stability, efficiency and scalability of FEI, attracting more Fei users.

With more users buying FEI, PCV increases. A greater PCV results in higher yields earned, which increase protocol equity and TRIBE Buybacks. The strategy that maximizes returns for TRIBE holders is to focus on growing FEI adoption. The impact of increasing Fei users can be much higher than ETH appreciation on existing protocol equity.

Let’s look at the numbers. TRIBE Holders voted for 20% APR for TRIBE Buybacks. It currently represents $ 180M in the first year. The buybacks happen continuously through a Liquidity Bootstrapping Pool from Balancer. It is like a dutch auction where we use minted FEI to acquire TRIBE. It is a constant and strong buying pressure in TRIBE.

This buyback amount represents ~35% of TRIBE circulating marketcap ($ 539M). According to the liquidity mining schedule, we will have ~ 90 M TRIBE used as incentives to increase the use of Fei Protocol. So, considering the current prices ($1.19), the buyback covers all the liquidity mining program and would still remain $ 60M. This is not common in DeFi.

Considering the current Protocol Equity of $ 892M, the book value of TRIBE would be $ 1.96. Today, TRIBE is traded at a Price to Book Value (P/BV) multiple of 0.57. It is a depressed multiple that still reflects the initial problems with the launch that were surpassed. The P/BV of growing companies is greater than 1. So, we can assume that the market is not considering the potential growth of Fei users. When Fei gains traction, we may see the market valuing Fei with other multiple levels, higher than 1.

In terms of PCV revenue, the return comes from ETH appreciation, stablecoin yields and also yield on minted Fei that is lent through other DeFi platforms.

If you are a TRIBE holder you have attractive options to earn yield with your tokens, such as supplying TRIBE to the FeiRari pool in Rari Capital or combining your TRIBE with FEI to supply LP tokens to the FEI/TRIBE Uniswap pool. Currently, the APR is between 37% and 56%.

Source: https://app.fei.money/farm

Besides the economic incentive, by holding TRIBE you own governance power to influence the decisions of the Fei Protocol.

By participating in TRIBE’s discussions, you can gain a deep knowledge of what is trending in DeFi and crypto. It formed a very smart community around Fei. Enthusiasm and friendship are two values you see among Fei community members.

Some people come to the community because of Fei’s decentralized nature, the DAO, stablecoin business and the uniqueness of Protocol reserves (PCV). They believe Fei can be the stablecoin for DeFi, the backbone for this sector. As Robert Leshner once mentioned, Fei has the potential to be the most important liquidity source in the entire DeFi ecosystem.

P.S.: Thanks for the comments DioDionysos and Sebastian Delgado.

Please note that this letter is not intended as financial advice.