There is a multi-trillion opportunity to connect Real-World Assets (RWA) and traditional finance to DeFi. Much bigger than all the crypto market cap of ~ $ 1 trillion.

More than that, by connecting these two worlds, DeFi can solve real problems for people. The financial system is a big machine that transforms dreams into reality. DeFis can bring more transparency, innovation and efficiency to this machine.

On April 21st 2021, MakerDAO made the first real-world asset-backed loan. It was the first time a real-world asset was used as collateral in a decentralized lending protocol. DAI minted against an NFT that represents real estate loans. We are just at the beginning of this financial innovation wave.

Source: Twitter

Centrifuge, a MakerDAO partner, is like a platform for credit funds that work in the blockchain. It has the senior and junior tranches. Anyone can invest by passing in the KYC and connecting a crypto wallet. It is also a way for DAOs to diversify their treasuries or DeFi Banks to diversify their collateral by using real-world assets. For borrowers they can provide competitive cost and agility.

Source: Centrifuge

Besides the deal with MakerDAO, Centrifuge also has other pools and investors. The loans include emerging market consumer loans, gig economy payment advances, revenue-based finance, fintech debt financing and others. It already has $ 90 million of Total Value Locked.

Source: Centrifuge and Docs

Another player is Goldfinch, which was founded by two ex-Coinbase employees and backed by top investors including Andreessen Horowitz, Coinbase and IDEO. Goldfinch is a decentralized credit protocol that is using crypto to empower financial inclusion around the world.

The protocol was announced in January 2021 and since then the loan book has doubled every 2 months to over $100M in active loans. Goldfinch has been experiencing exponential growth and now serves 1 million people and businesses via its borrowers across three continents and 20+ different countries.

One interesting case is the funding given by the Goldfinch community to Divibank, a LatAm fintech that offers its customers revenue-based financing to fund their digital marketing campaigns. It was a $5M borrower pool to fund the growth of its operations in Brazil.

Coming back to the MakerDAO case, we can see that they already have, in total, $ 40 million in loans backed by Real world Assets.

Source: Maker DAO Dashboard for RWA Operations

New Silver was the first one. They provide loans for real estate mortgages, with a focus on-term 12-24 month loans. They tokenize these real estate assets into NFTs and use them as on-chain collateral. Another relevant MakerDAO loan was to 6S Capital ($15 million) which is also related to real estate in the USA. It is a pre-leased build-to-suit single-tenant commercial real-estate project, one for O’Reilly and the other for Tesla.

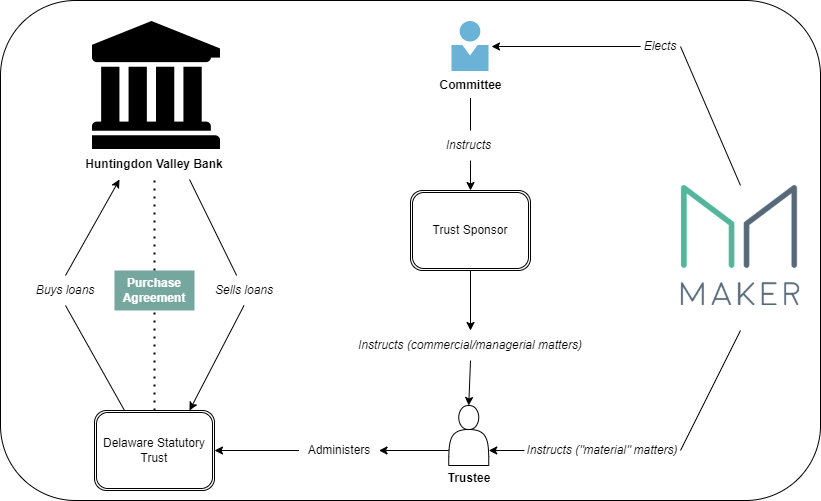

This month MakerDAO made two more big steps, the first, a loan with a $ 100 million ceiling to the Huntingdon Valley Bank, a Pennsylvania Chartered Bank founded in 1871. The expected net yield is 3% per year. It’s the first time a DeFi bank is lending to a traditional U.S. bank. And it has the potential to increase the RWAs loans from MakerDAO by 3x.

Source: Maker DAO

If successful, the legal framework developed for this operation can help MakerDAO onboard other commercial banks as opportunities arise. The Delaware Trust would be ready to engage with other financial institutions.

Source: discussion and HVBank proposal

The second step was a loan of $30 million to Societe Generale, one of Europe's leading financial services groups and a major player in the economy for over 150 years.

The news is not over. One of the biggest DeFi protocols, Aave, just announced that they will launch GHO, a new collateral-backed stablecoin with USD parity. When approved by AaveDAO governance, an investor or institution can borrow GHO by depositing different types of collateral. From a lending marketplace, Aave is now becoming a DeFi bank. It also opens room for the onboarding of real-world assets.

Source: Introduction of GHO

By different paths, real-world assets are meeting DeFi. It is just the beginning of a wave of opportunities.

Great article, as always. When more?