What DAOs can learn from Corporate Governance?

Hello Kailashers, let’s talk about DAO governance today. One of the most relevant DeFi protocols, MakerDAO, is under an interesting discussion on how to improve the community decision-making process by creating a constitution and establishing a Council.

The purpose of this article is to bring lessons learned from corporate governance that could be adapted to DAO reality. It can help in defining the role of each player in this system.

The corporations and DAOs face the principal-agent problem (Agency theory). The interests of the agent that makes the decision are not necessarily aligned with the principal that is affected. DAOs have similar problems to corporations with dispersed ownership.

Before diving into corporate governance, I highlight the three central DAO Governance challenges identified by Professor Andy Hall from Stanford:

Participation: low participation of token holders in the governance

Information and expertise: making smart, informed decisions about complex, technical issues in a context where most token holders are unlikely to have the necessary time or expertise.

Aligning incentives: Aligning the incentives of the DAO stakeholders.

I believe we need to test new models of voter delegation, periodic elections, labor division, compensation and incentives for delegates. Let’s see how the good practices of corporate governance can help us.

Corporate Governance and DAOs

The key basic principles of corporate governance that guide all the practices are:

Transparency: Consists in the desire to provide stakeholders with all the information that is valuable to them

Accountability: The governance actors must account for their actions in a clear, concise, comprehensible and timely manner, taking full responsibility for the consequences of their acts and omissions

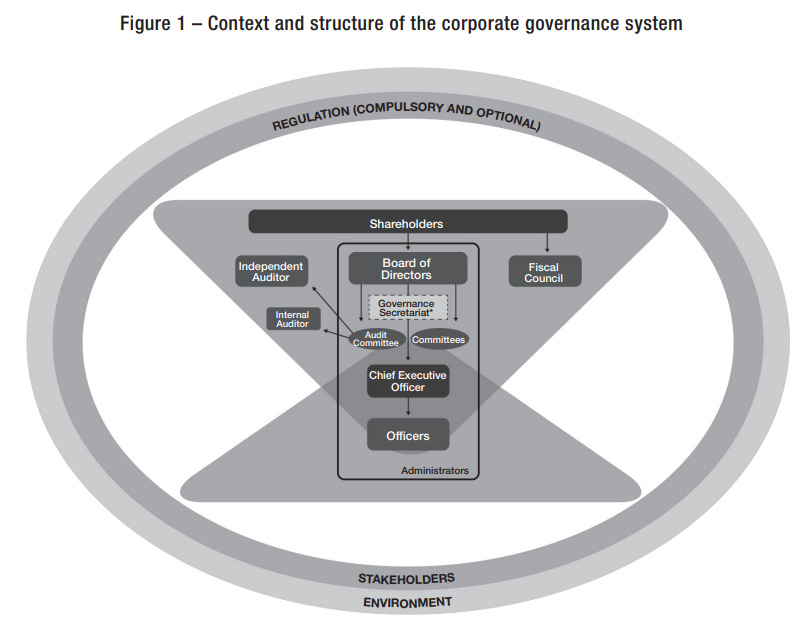

The governance system can include the following structures aiming to provide checks and balances:

In the sections below I highlight some extracts in italic from the Code of Best Practices of Corporate Governance and provide my comments when indicated.

By-laws/Articles of incorporation

It is the contract that, as a complement to the legislation in force, governs and defines how the organization operates, including the organizational level and responsibilities of each governance actor. It contributes toward transparency to the organization’s governance system, and to promote trust in its relations with all relevant stakeholders.

In corporate governance, there are supervisory and control bodies. In Brazil, there is the fiscal council as part of the system. It reports to the shareholders, independent from the administrators (board of directors and officers). It is responsible for reviewing the financial statements for the fiscal year and expressing a corresponding opinion, to supervise, through any of its members, the acts of administrators and to verify compliance with its legal and statutory duties. There is no variable compensation for fiscal council members.

The independent audit team should report directly to the board of directors. Supported by the work of the independent auditors, the administrators are responsible for ensuring the integrity of the organization’s financial statements, prepared in accordance with the accounting practices in place.

The by-laws/articles of incorporation may require that transactions between related parties be approved by the board of directors (with the exclusion of any members with potentially conflicting interests). Whenever necessary, transactions between related parties must be sustained by independent reports, prepared based on realistic assumptions and information supported by external sources.

Comment:

It is similar to the constitution idea being discussed in MakerDAO. It is an opportunity for communities to create alignment on purpose and principles. In this regard, I highly recommend reading the book below about creating and cultivating impact networks and the toolkit on their website. Establishing purpose and principles is not only a good practice in corporate governance but also in network coordination. The constitution should also clarify the responsibilities of key stakeholders within the system.

Something similar to a fiscal council could be good in DAOs like Lido or Maker, where the actions of token holders affect other parts not directly involved in the governance, such as stETH or DAI holders. For specific actions, they could have veto power. An example of the veto power working in practice is explored by Sébastien from MakerDAO in the figure below, where stablecoin/bonds holders could use their tokens to vote on trustee/covenant changes (being proposed by governance holders) or a proposal that would put the protocol insolvent.

The Gyroscope Protocol, a stablecoin project, also introduces this concept of veto for specific actions. Should governors try to deviate from the shared vision of the protocol, Gyro Dollar holders will be able to exercise optional veto powers during the time delay to stop it. Ordinarily, Gyro Dollar holders will not need to do anything if governance actions are sound. However, if governance actions are contentious, Gyro Dollar holders can exercise the veto to block the action.

Establishing this additional council may help to increase the coordination among veto power holders, increase their participation in the system and improve the checks and balances.

Another important structure governance actor is the independent auditor. Who audits the financial statements and non-financial information from DAOs? Even though most of the data is transparent in the blockchain, it can be difficult to summarize all the information and provide it in a clear way to the stakeholders. Is it time to have Audit DAOs building their reputation in the space?

Board of Directors

The board of directors is the central body of the governance system. It serves as the guardian of the principles, values, purpose and system of governance of the organization, being its main component. The members of the board of directors are elected by the shareholders.

As administrators, the directors have fiduciary duties to the organization, and must be accountable to the shareholders. In a broader and periodic manner, they must also be accountable to shareholders and other stakeholders by presenting the financial statements.

Board members have duties to the organization. The concept of a board member representing any stakeholder is inadequate. It must exercise its duties with consideration for the organization’s social purpose, its long-term viability and impacts resulting from its activities, products and services on society and its stakeholders (externalities).

Board of Director responsibilities:

Define the strategic direction of the business

Approve the annual budget

Ensure that the executive management implements a risk management policy, by having processes that identify, mitigate and monitor the risks faced by the organization

Select the chief executive officer (CEO) and approve the appointment of other executive management members;

Define the executive management’s compensation and incentives policy

Monitor the financial and operational performance of the executive management;

Approve policies and guidelines that affect the organization as a whole;

Ensure the search and implementation of innovative technologies and processes that keep the organization competitive and up to date with market and governance practices;

Participate in the decisions concerning capital investment projects that have a significant impact on the organization’s value;

Choose and evaluate the independent auditors;

Ensure that the financial statements clearly and accurately reflect the organization’s economic, financial, and accounting position;

Comment:

In general, I like the Council proposal from MakerDAO as it goes in line with good practices of corporate governance.

My suggestion is to add to the Council some of the responsibilities described above, such as: ensuring risk management policy within the DAO, monitoring and evaluating Core Unit performances, ensuring the compensation policy is appropriate, choosing independent auditors, etc. This way the Council can help to provide the checks and balances on the governance system.

The problem with the current delegate system is that they have no incentive to specialize, make proposals and be a balance for the power of Core Units. The incentives are to participate in the greater number of proposals and talk in the forum, as they are compensated based on quantity, not quality. An alternative would be to have a minimum threshold and up to that Delegate receive their compensation. Transparency about participation and communication activity is interesting, but linking it directly with compensation in a linear way provides bad incentives for superficial participation. This topic is worth a separate discussion.

Adding a Council structure may improve this governance system. A Council will have the proper incentives for more propositive participation, improving the checks and balances in the system. It is like creating a subDAO, it is more a division of labor than a hierarchy. The greater merit in my opinion is to establish the incentives to have specialists elaborating proposals thinking in the long-term development of the project.

A difference in the MakerDAO case is the coexistence with Delegates and that the Council has no formal decision-making power. To reduce the number of proposals the token holders need to vote for, it could be implemented an optimistic governance model for specific kinds of actions.

Composition:

The composition of the board of directors must consider diversity of knowledge, experiences, behaviors, cultural aspects, age and gender.

An odd number of members between five and eleven is recommended.

Independence of board members:

Once elected, all board members have a responsibility to the organization, regardless of the shareholders, shareholder group, administrator or stakeholder who appointed them to the position.

Board members who are conflicted on a particular matter must refrain from participating in the discussion and the decision on that specific issue.

The role of independent directors is especially important in companies with dispersed ownership, without a clearly defined controlling shareholder, in which the predominant role of the executive management must be counterbalanced.

To promote independent judgment by all board members and the integrity of the governance system, the appointment of internal members to compose the board should be avoided.

Comment:

I believe this independence is important and the Council should not have Core Unit members as the idea is to have a labor division in governance and checks and balances in the system.

Term of office

The term of office of board members should not exceed two years.

Third sector organizations may choose to adopt a partial or staggered renewal of its board members.

Reelection may be desirable to compose a productive and experienced board of directors, provided that it is based on evaluation results.

The annual evaluation results must be taken into account in the decision of whether or not to renew a board member’s term or to confirm their independent status, regardless of how long they have served on the board. The criteria for renewal must be expressly stated in the by-laws/articles of incorporation or in the board’s internal regulations. To avoid life-long tenures, the by-laws/articles of incorporation may specify a maximum number of years of continuous service on the board.

Comment:

In the case of DAOs, I think the term should not exceed one year and the council could be evaluated every 6 months.

Compensation of board members

The board members must be adequately compensated, considering the market conditions, the qualifications, the value generated to the organization and the risks concerning the activity. Proper compensation furthers the alignment of objectives and prevents conflicts of interest.

The board members should not be compensated based on the number of meetings attended. Equal, fixed monthly compensation for all members is recommended.

Compensation criteria for the board of directors should be different (incentives, metrics and terms) than that of the executive management, due to the distinct nature and roles of these bodies within the organization.

Comment:

I agree with a fixed monthly compensation equal for all members. I am not sure if including a variable remuneration for council members would be a good practice.

Budget of the board and external consulting

The organization benefits from a board of directors that can act in an independent and well-informed manner, which may require the assistance of third-party advisory services. As a result, the board should have sufficient financial resources for this purpose.

Comment:

I believe this could be applied to MakerDAO Council to empower it to hire third-party advisory services if needed.

Committees of the board of directors

The committees have no power of decision, and their recommendations are not binding on the decisions of the board of directors.

Board committees may include: audit; finance; human resources; risks; sustainability.

Comment:

This could be a way to foster specialized discussions in strategic areas like the ones described above.

DAO Ecosystem and Governance

In the sections above we discussed the incentives, the participants and the structures of the decision-making. Following the simple framework below, another front to advance is to reduce the scope of decisions to be made with governance. Governance brings a cost and uncertainty. A good example of a Protocol DAO with minimum governance is Uniswap.

DAOs are a flexible organization model and there are many types out there. In this article, we focused on the case of MakerDAO. For different DAOs we may have different governance solutions to be tested.

P.S.: Thanks for the comments from Sébastien Derivaux.

Please note that this letter is not intended as financial advice.